Offshore Company Formations for Consultancies: A Practical Resource

The Crucial Solutions Associated With Offshore Company Formations: Making Informed Selections

Offshore company formations require a comprehensive understanding of various essential solutions (Offshore Company Formations). Legal compliance, monetary advisory, and banking services play important roles in establishing a successful entity. Each service adds to efficient decision-making and operational performance. However, the ins and outs entailed can be frightening for many businesses. Understanding exactly how to browse these intricacies is crucial to achieving sustainable development and safeguarding stakeholder interests. What are the particular strategies that can direct companies through this process?

Comprehending Offshore Business Structures

While numerous individuals and services look for to establish offshore companies for various strategic factors, understanding the underlying frameworks is important. Offshore firms normally take numerous kinds, including restricted responsibility companies (LLCs), international organization companies (IBCs), and collaborations. Each framework offers unique benefits, such as liability security, tax advantages, and boosted privacy. For instance, LLCs supply minimal responsibility, protecting personal properties from business debts, while IBCs are preferred for their adaptable management and tax efficiency.

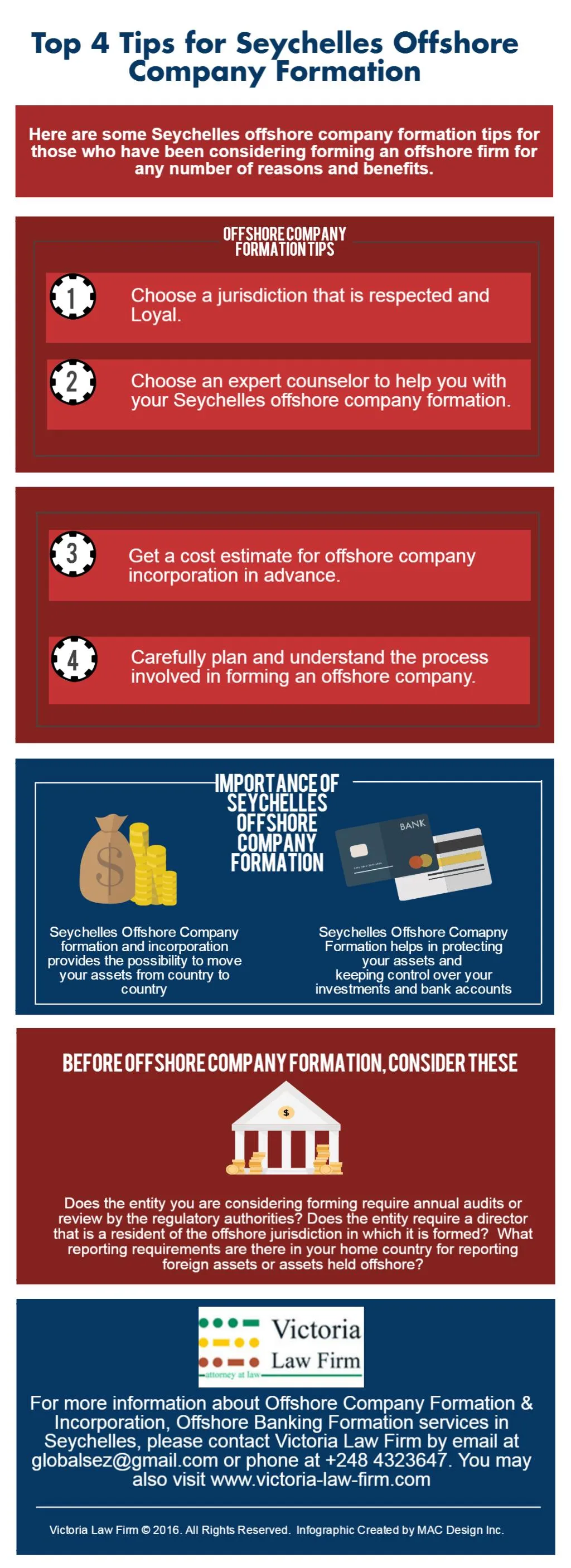

Moreover, the option of jurisdiction considerably influences the overseas business's framework. Different areas existing differing policies, tax obligation implications, and functional freedoms. Entrepreneurs have to think about factors such as political stability, financial setting, and the credibility of the territory. Ultimately, a knowledgeable understanding of these frameworks makes it possible for individuals and services to make strategic choices that line up with their purposes while guaranteeing conformity with worldwide standards.

Legal Services for Compliance and Enrollment

To guarantee that overseas companies operate within the lawful structures of their chosen jurisdictions, appealing lawful solutions for conformity and enrollment is necessary. These solutions ensure that all needed documentation is properly ready and sent according to local regulations. Lawful experts assist in passing through complicated regulations, assisting to stay clear of possible challenges that can lead to fines or lawful disagreements.

Additionally, they provide assistance on the details requirements for company enrollment, consisting of name authorizations, director certifications, and shareholder agreements. Ongoing compliance is similarly crucial; lawful services help maintain adherence to reporting and functional commitments, which can differ substantially throughout territories.

Moreover, lawyers often offer understandings into best practices for company administration, assisting in a smooth functional circulation. By protecting specialized lawful services, offshore firms can concentrate on their core tasks while ensuring they remain in excellent standing with regulative authorities. Ultimately, this strategic financial investment improves the longevity and success of business

Financial Advisory for Tax Optimization

Involving monetary advising services for tax obligation optimization is necessary for offshore business seeking to maximize their profitability and lessen tax liabilities. These solutions offer crucial understandings right into various tax obligation jurisdictions, making it possible for companies to browse complex regulations properly. By leveraging expert expertise, overseas entities can identify ideal structures that assist in tax obligation effectiveness, such as holding companies or special objective vehicles.

Furthermore, financial consultants can aid in creating strategies that straighten with international tax obligation laws, ensuring compliance while maximizing tax responsibilities. This consists of analyzing transfer pricing, making use of tax treaties, and making informed choices on repatriation of profits. A tailored technique to monetary consultatory not just aids in mitigating risks connected with tax obligation audits yet additionally enhances general monetary wellness.

Inevitably, effective financial advisory for tax optimization equips overseas business to make calculated economic choices, causing lasting growth and improved competition in the international market.

Financial Solutions for Offshore Entities

When developing an overseas entity, recognizing the numerous account types available is important for effective banking solutions. Compliance with banking policies is necessary to ensure the legitimacy and security of operations. A knowledgeable method to these aspects can significantly improve the monetary administration of overseas firms.

Account Kind Introduction

As services think about offshore firm developments, understanding the numerous account types available for these entities comes to be considerable. Offshore firms normally have access to numerous banking remedies tailored to their demands. Common account kinds include individual accounts, which allow private firm proprietors to handle their financial resources, and corporate accounts created specifically for service transactions. Multi-currency accounts allow firms to negotiate and hold in various money, supplying flexibility in global transactions. In addition, merchant accounts promote online payment handling, essential for ecommerce procedures. High-interest interest-bearing accounts can likewise be helpful for companies looking to gain returns on their still funds. Each account type offers unique benefits, making it important for entrepreneur to pick one of the most suitable options for their functional requirements.

Banking Regulations Conformity

Although overseas companies supply a series of banking options, compliance with financial guidelines remains a critical consider their operations. Governing frameworks differ significantly across jurisdictions, requiring a comprehensive understanding of details requirements for each overseas entity. This compliance assures that business stick to anti-money laundering (AML) and know-your-customer (KYC) protocols, which are essential for maintaining the authenticity of their economic activities. Furthermore, non-compliance can bring about severe fines, including the cold of accounts or lawful effects. Involving with experienced lawful and financial experts can help offshore business browse these complex policies. Inevitably, an aggressive method to banking conformity not just safeguards the business's passions but also improves its online reputation in the global business landscape.

Business Governance and Administration Solutions

Company administration and management services play an essential duty in the reliable operation of offshore business, making sure conformity with global policies and regional legislations. These services include the establishment of a robust framework that defines the functions, obligations, and responsibility of the business's management. This framework advertises openness, moral decision-making, and stakeholder involvement, which are crucial for maintaining business integrity.

In addition, administration services often consist of the stipulation of knowledgeable experts who look after everyday operations, strategic preparation, and risk about his monitoring. These experts aid to navigate the complexities of worldwide company environments, making certain that the business remains receptive and agile to market adjustments.

Accountancy and Bookkeeping Demands

In the context of offshore firm formations, audit and bookkeeping needs play a vital duty in guaranteeing regulatory compliance. Firms need to abide by specific economic reporting requirements that differ by jurisdiction, which can affect their functional methods. Recognizing these necessities is crucial for preserving openness and avoiding prospective lawful issues.

Regulative Compliance Necessities

What vital actions must offshore companies take to validate governing compliance in their accountancy and bookkeeping practices? They need to acquaint themselves with the certain laws of their jurisdiction to guarantee adherence to regional regulations. This includes maintaining precise monetary records that show all purchases, which is vital for transparency. Offshore companies ought to additionally implement a regular review procedure to confirm conformity with tax commitments and economic coverage needs. Correct documentation should be maintained to assist in and sustain economic declarations audits. In addition, involving with specialist try this website accountants experienced in overseas policies can offer important guidance. By focusing on these practices, overseas companies can reduce threats and maintain their reputations in the international marketplace.

Financial Reporting Standards

Understanding financial coverage criteria is critical for offshore firms, as these guidelines determine how monetary info needs to be videotaped and reported. Sticking to these standards assurances openness and compliance with international laws, which can significantly impact a firm's reputation and functional effectiveness. Different jurisdictions might have varying needs, demanding a detailed understanding of neighborhood regulations along with worldwide standards like IFRS or GAAP. Exact accountancy and bookkeeping techniques are essential, enabling business to maintain accurate monetary documents, facilitate audits, and existing clear financial declarations. Furthermore, trusted financial coverage can enhance decision-making procedures and foster trust among stakeholders, including investors and governing bodies. Subsequently, choosing the appropriate economic coverage framework is necessary for the long-term success of overseas enterprises.

Due Diligence and Threat Analysis Techniques

Due diligence and danger about his evaluation offer as important columns in the offshore company formation procedure, giving a structure for reviewing potential legal, monetary, and functional risks. Efficient due persistance entails thorough examinations right into the regulatory environment, prospective tax implications, and the reputability of solution carriers. This process aids identify any warnings that may affect the practicality of the venture.

Risk assessment approaches must include assessing the jurisdiction's stability, conformity demands, and any geopolitical factors that might influence company procedures. Business ought to also take into consideration the economic health and wellness of potential companions and the overall market conditions to minimize unanticipated obstacles.

Executing an outlined due persistance and threat assessment technique not just safeguards the rate of interests of the stakeholders but also boosts the long-term success of the overseas entity. By making informed selections based upon thorough evaluation, companies can browse the complexities of overseas formations with higher self-confidence and lowered threat.

Frequently Asked Questions

What Are the Initial Costs of Forming an Offshore Firm?

The initial costs of forming an overseas firm generally consist of registration fees, legal expenses, and company fees. These expenses can differ considerably based upon jurisdiction, intricacy of the framework, and additional solutions required.

Just how Long Does the Offshore Firm Formation Process Take?

The overseas company development process generally takes in between one to 4 weeks, depending on territory and certain needs. Elements such as documents efficiency and regulative compliance can affect the total timeline considerably.

Can I Type an Offshore Business Remotely?

The inquiry of remote overseas firm formation arises regularly. Many jurisdictions permit individuals to complete the needed documentation and procedures online, enabling them to establish companies without being literally existing in the nation of enrollment.

Exist Ongoing Compliance Demands for Offshore Firms?

Recurring conformity needs for overseas business frequently consist of annual filings, tax obligation obligations, and preserving precise records. These policies vary by jurisdiction, necessitating careful management to guarantee adherence and avoid prospective lawful complications.

What Are the Possible Risks of Offshore Company Formations?

The prospective dangers of offshore company formations consist of lawful issues, tax evasion accusations, regulatory examination, and potential loss of online reputation. Additionally, fluctuating political climates might impact stability and functional stability in international jurisdictions.

Offshore firms usually take a number of forms, consisting of restricted obligation business (LLCs), worldwide company firms (IBCs), and collaborations. Engaging economic advising solutions for tax optimization is important for overseas firms looking for to maximize their productivity and lessen tax obligations. Offshore companies need to likewise apply a routine evaluation process to confirm compliance with tax commitments and economic coverage needs. Comprehending economic reporting requirements is vital for overseas companies, as these guidelines determine how financial details ought to be videotaped and reported. Due diligence and risk analysis offer as necessary columns in the offshore firm formation procedure, providing a framework for examining prospective lawful, monetary, and functional risks.